A judge annuls a bank debt because the letter of the contract was too small, based on the fact that the size of the characters must by law be greater than a millimeter and a half

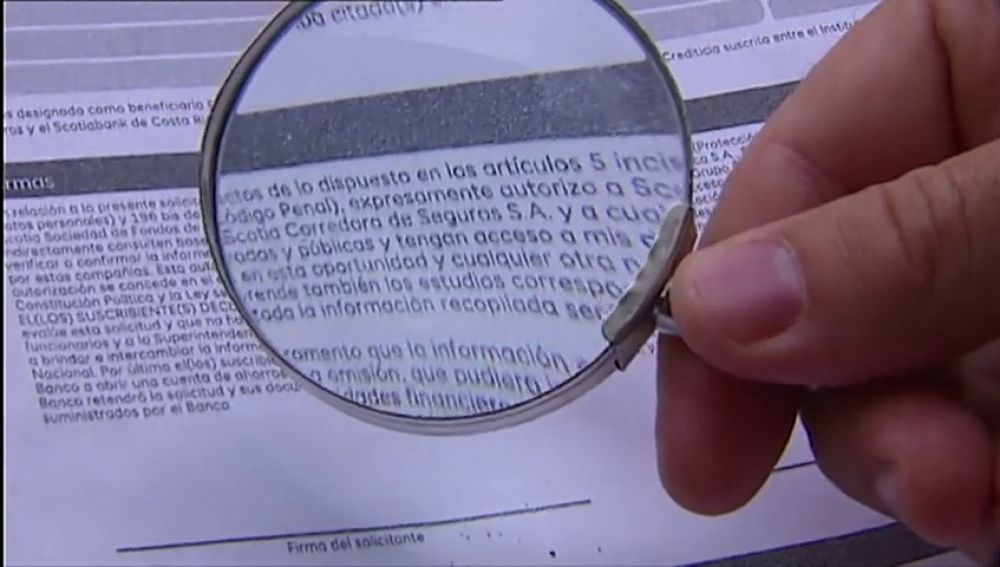

A court of first instance in Seville has declared the conditions of a user's contract abusive for a formal matter, based on the size of the letter, alluding to a lack of clarity as it has a dimension of half a millimeter, one third of the minimum established by law.

According to the Diario de Sevilla, the client has thus avoided a requirement of 2,989 euros that the entity had required her to pay as non-returned credits.

Rubén Sánchez, spokesperson for the FACUA-Consumers in Action association, explains that the judge has simply applied a law that already exists and that establishes the minimum size of the letter that must be used in these contracts. Sánchez refers to article 80 of the General Law for the Defense of Consumers and Users, which determines the requirements of the clauses that are not negotiated individually between companies and clients. The standard requires its "accessibility and legibility", so that the client has prior knowledge of the content of the agreement. "In no case will this requirement be understood to have been fulfilled if the size of the letter of the contract is less than one and a half millimeters or the insufficient contrast with the background makes it difficult to read," reads the text.

"When the rule came into force, it was said that it was the end of the small print, but I say that it was the end of the small print," says Sánchez, who explains that this provision was the result of European legislation.

In the case of the Sevillian user, the illegible handwriting referred to the section that established the financing conditions of the credit card. The judge decreed that the typeface used prevented its reading unless "increasing mechanisms" were used, reports the local press, which adds that it was not proven what the credit from which the client benefited was and that it was not returned. In Spain, it is not the first time that an illegible handwriting invalidates a bank contract or part of it. In November 2017, the Provincial Court of Castellón annulled a clause in a credit card contract because it could only be read with a magnifying glass.

The Sevillian woman saw how the bank claimed a debt of 6,000 euros for unrepaid credits. His lawyer stated that this amount was not justified and that the contract had abusive clauses, in addition to the fact that the financial conditions did not appear and the text was illegible, reported the Diario de Sevilla.

Sánchez recalls that the lack of transparency, the non-existence of a clause, or the fact that the company never delivers the contract to the client are other recurring abuses that the consumer has to face.

In 2012, the Bank of Spain published a circular that developed the ministerial order for transparency and protection of financial services customers, in which it decreed that the font size in banking contracts could not be less than one and a half millimeters in height. Then, the Association of Users of Banks, Savings Banks and Insurance of Spain (Adicae) claimed that, more than typography, it was necessary to get their hands on the contents of the agreements, often difficult to understand and not very transparent. "Sometimes the excess of information is a double-edged sword because it makes all the responsibility fall on the consumer," the association comments by email, which together with other consumer organizations promoted the proposal for a law on transparency in predisposed contracting that it is now being processed in Congress, and which has the objective of strengthening consumer protection against abusive clauses by imposing greater transparency in contracts.