Reforms in the contribution system for the self-employed

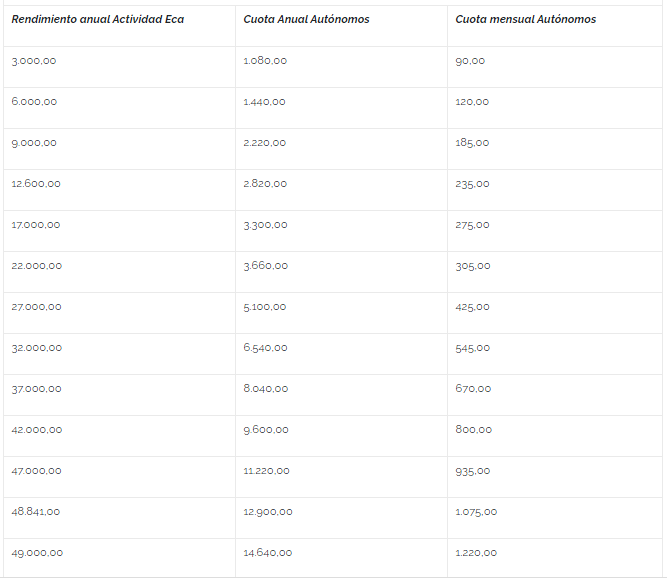

The government intends to reform the contribution system for self-employed workers by linking their real income to their contribution to the special social security regime. In this sense, the proposal made by the Ministry of Inclusion, Social Security and Migrations is summarized in the following table:

Five tranches are established below €22,000 of annual income that would pay a lower quota than the current one. The rest of the self-employed would see their contributions increase.

The president of ATA (Association of self-employed workers) has assured that "updating contributions to yields" is "working in many cases for the State and not for us", "adding what the self-employed have to contribute in personal income tax and contributions, there are self-employed workers who will exceed 50%.

In the following table you can see what corresponds to pay personal income tax to self-employed workers based on their work income:

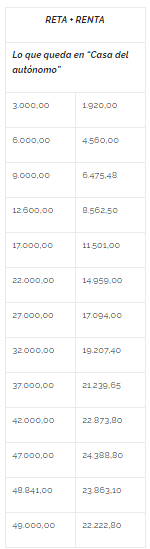

In the following table you can see what "stays at the home of the self-employed after paying the contributions to RETA and personal income tax:

The president of ATA has added "This system proposed in this way, impoverishes the self-employed, promotes the underground economy and discourages activity from certain billing brackets" and "By the way, it is striking that there are sections with lower net income that in the end, the self-employed person has more available for his home than others with higher net income such as between €42,000 and €48,000 of annual net income compared to higher net income."

This system of new sections for the self-employed in Social Security contributions will be included in the first package of reforms that the Ministry plans to approve shortly, but it will not be implemented until January 1, 2022 and will not have economic effects until 2023. It would not be fully deployed until 2032.

The draft is not yet official nor has it been recognized by the Ministry and it should be noted that ATA does not accept the current proposal for quotes on real yields.

Modify the sections for the self-employed in Social Security contributions

The self-employed will be able to provisionally choose their contribution base among the 13 indicated in the table based on their yield forecasts with the possibility of modifying their choice 6 times throughout the year to adjust it to their yields.

If there are differences once the annual regularization is done, the worker must proceed with their income if they have contributed less than what corresponded to them and may request a refund if the contribution made was higher.

What does a self-employed fee currently pay?

The minimum fee that a self-employed person currently pays (without taking into account a flat rate) is €286.15/month, whose contribution base is €944.4/month (for 2020 the rate was established at 30.3% in Decree Law 28/18 and has not yet been updated to 30.6% for 2021 by virtue of RD Law 2/21). Depending on the age you have, you can choose minimum and maximum bases, determined for each year in the PGE.

First, the contribution base (BC) is chosen, and the percentages of each coverage option that we have chosen are applied to it. The quota from January 1, 2019 includes all the contingencies that until now were voluntary, such as protection for cessation of activity and professional contingencies.

Source: INEAF