News

Aseryde

Work punishes companies for 'improper' payments of ERTEs

Entrepreneurs become jointly responsible for the debt The offices foresee a high cost for employers The Ministry of Labor and Social Economy has converted the claim of 'improper payments' into the Employment Regulation Files (ERTEs)...

The obligation of the worker to deliver his medical leave is eliminated

The public health service or, where appropriate, the mutual, will send the reports electronically but the new system is not immediate The BOE of Thursday, January 5, 2023, publishes the royal decree that eliminates the obligation of workers to deliver your share...

The VAT reduction on some essential products, one of the approved measures to support families

As of January 1, and valid until June 30, 2023, the VAT applicable to certain essential products is modified, in accordance with the provisions of RD Law 20/2022 of December 27, on response measures to the economic consequences and...

Modifications in VAT for 2023: 0% in staple foods, and a drop in 5% in oil and pasta

The Government has announced the third anti-crisis package approved by the Council of Ministers with aid, among others, for food, as well as the end of the general discount of 20 cents on fuel, which will only be maintained for professionals. He...

The Social Security publishes examples of how the self-employed should calculate their quotas for real income

Social Security has published several examples to explain to the self-employed how to calculate their contribution for actual earnings. Both for freelancers in direct estimation and in modules. Experts recommend looking at the contribution base...

How much can you save if you register as a freelancer before the flat rate changes on December 31, 2022

By now, surely you already know that on January 1, 2023, a new Social Security contribution system for the self-employed will begin to operate, which will set the fee paid based on their real income. Also, this new system...

The experts propose to Díaz an increase in the minimum wage of between 46 and 82 euros per month by 2023

The Government must decide now, before the end of the year, the final increase that applies to this legal minimum income The group of experts commissioned by the Ministry of Labor to study what would be the increase in the minimum interprofessional wage necessary for this...

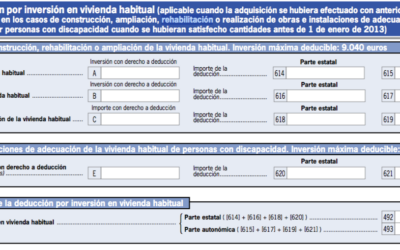

Maximize the deduction for habitual residence before the end of the year

If you acquired your habitual residence before 2013, you should calculate the maximum amount that can be deducted in the 2022 return All those taxpayers who acquired their habitual residence before January 1, 2013, enjoy the deduction...

Labor refuses to change the law to depoliticize the SMI

Díaz's number two defends the "maximum transparency" of the current systemBrussels proposes that employers and unions also set the criteriaThe current law does not 'shield' the independence of the group of experts either The Government will not modify the legislation that...